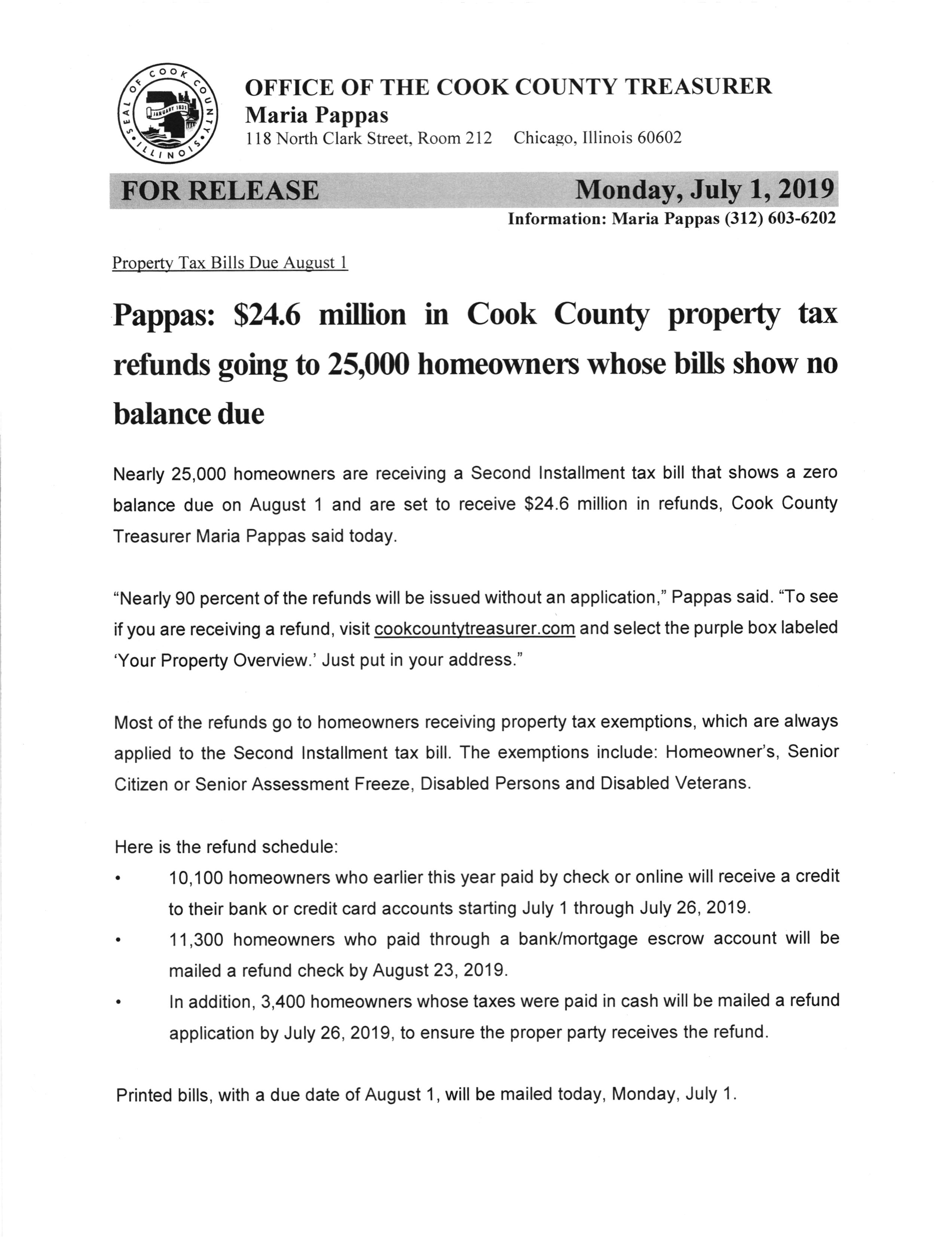

Cook County Senior Exemption 2024

BlogCook County Senior Exemption 2024. Most homeowners are eligible for this exemption if they meet the requirements for the homeowner exemption and were 65 years of age or older. Cook county offers two tax exemptions for seniors.

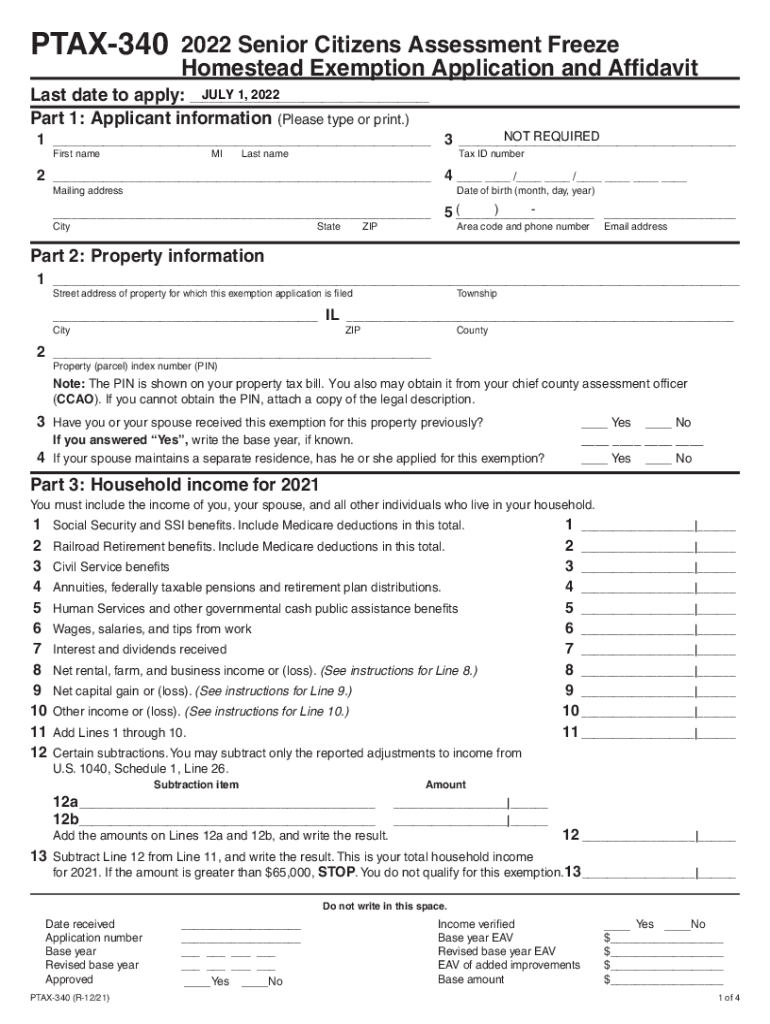

26 rows fritz kaegi, cook county assessor. Be a senior citizen with an annual household income of $65,000 or less.

Senior homeowners are eligible for this exemption if they are over 65 years of age and have a total household annual income of $65,000 or less in the 2020 calendar year.

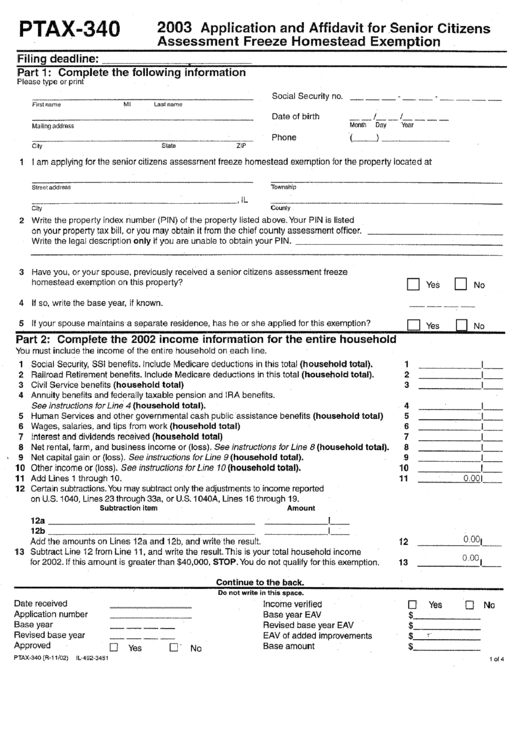

2023 Senior Citizen Exemption Application Form Cook County, To receive the senior citizen homestead exemption, the applicant must have owned and. Exemptions that can reduce a property owner’s taxes are.

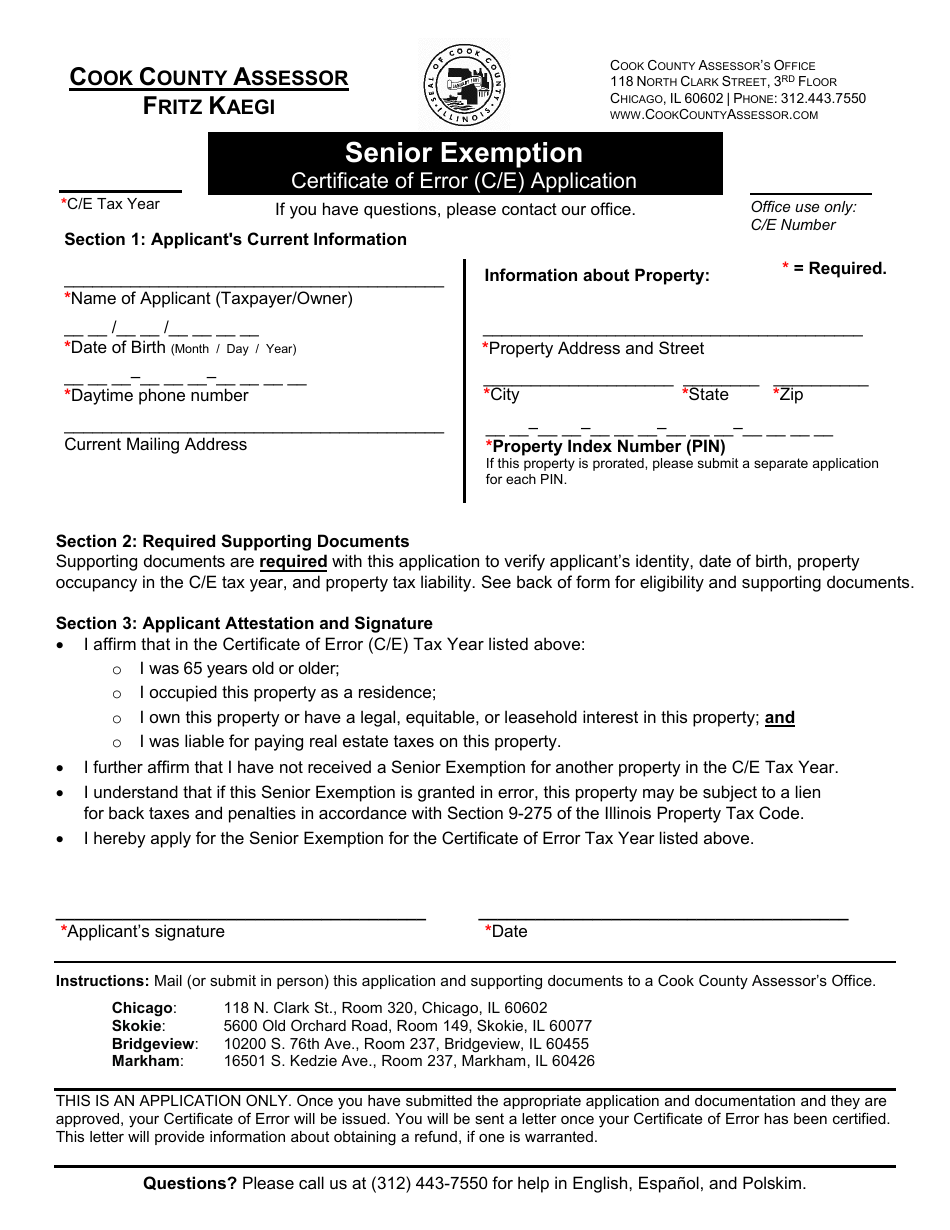

Cook County, Illinois Senior Exemption Certificate of Error (C/E, How are senior exemption savings calculated? April 26, 2024 at 3:01 p.m.

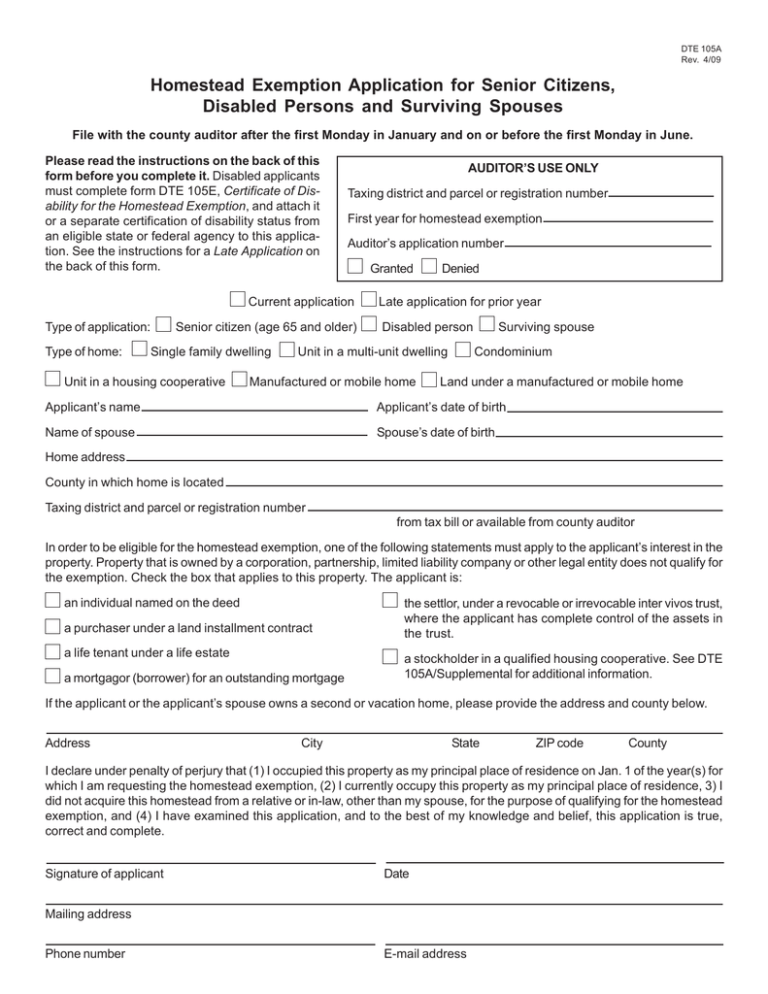

Homestead Exemption Application for Senior Citizens, Disabled Persons, Copy of proof of age and residency. Be a senior citizen with an annual household income of $65,000 or less.

Rev 1220 As 9 08 I Fill Online, Printable, Fillable, Blank pdfFiller, Eav is the partial value of a. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the homeowner exemption.

Cook county divorce forms Fill out & sign online DocHub, Have owned and occupied the home on. Seniors can save, on average, up to $300 a year in property taxes, and up to $750 when combined with the homeowner exemption.

Cook County Senior Property Tax Exemption Property Walls, Most homeowners are eligible for this. Eav is the partial value of a.

2023 Senior Citizen Exemption Application Form Cook County, If you received an application booklet in the mail, please mail it in. To apply for a prorated senior exemption you must submit a:

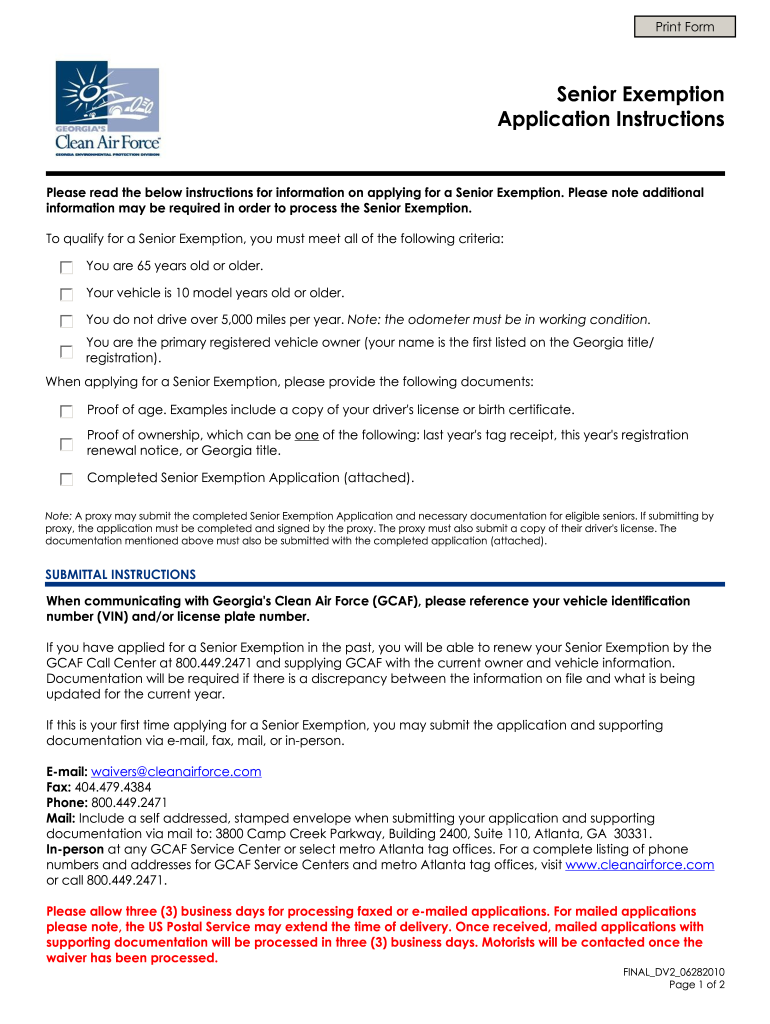

Clean air force senior exemption application Fill out & sign online, By chronicle staff on january 18, 2019. Most homeowners are eligible for this exemption if they meet the requirements for the homeowner exemption and were 65 years of age or older.

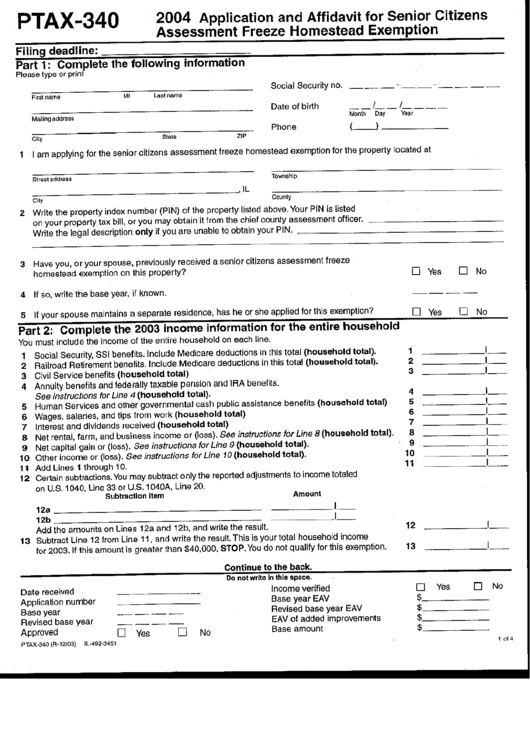

IL PTAX340 2022 Fill and Sign Printable Template Online US Legal Forms, If you received an application booklet in the mail, please mail it in. Provides that, beginning in taxable year 2024, the maximum income.

Fillable Online Senior Citizen Assessment Freeze Exemption Kane, The first installment is 55% of the previous year's total tax. Amends the property tax code.